Can someone from TaxTim phone me?

Written by Nicci

Posted 10 September 2024

TaxTim provides an online service only, with all communication handled exclusively through email via our Helpdesk. This approach ensures that your queries are centrally tracked, kept confidential, and addressed by the appropriate team members within our organization. We do not offer phone support, so clients cannot call us, and we are unable to make outgoing calls to clients or contact...

Read more →

How to refresh your import data on eFiling

Written by Alicia

Updated 30 May 2023

If your employer, medical aid, retirement annuity, or investment fund has informed you that the tax certificate they provided is outdated and that they have sent a new tax certificate to SARS, but your tax return is still displaying old data, what steps can you take to fix this issue?

We've had a couple of taxpayers over the years contact us with this problem, and fortunately there is actually quite a simple way to fix it.

Please follow these steps:

1. Log ...

Read more →

Why is my IRP5 not being imported from eFiling?

Written by Alicia

Updated 15 May 2023

The helpdesk has been inundated with questions asking why TaxTim is unable to import IRP5 details from eFiling and why taxpayers have to manually enter all the data that had usually been imported in previous tax years.

Here's a few reasons, why you may be experiencing this issue:

- The tax season usually opens 1 July each year - if you are trying to complete your tax return early (i.e from 1 March) your data will not be available on eFiling as all instit...

Read more →

Can I delete a tax return on eFiling?

Written by Alicia

Posted 21 February 2023

Did you start a wrong tax return on eFiling by mistake? This could happen for example, if you selected the wrong tax year.

Can you delete the tax return and start again?

Unfortunately not - once a return has been requested on SARS eFiling, there is no way to delete it. It will show under Returns Issued as a ‘Saved’ version on your SARS profile. You don’t need to worry about it though. As long as it is not submitted, SARS will ignore it.

Read more →

How do I delete a tax return on TaxTim?

Written by Evan

Updated 20 February 2023

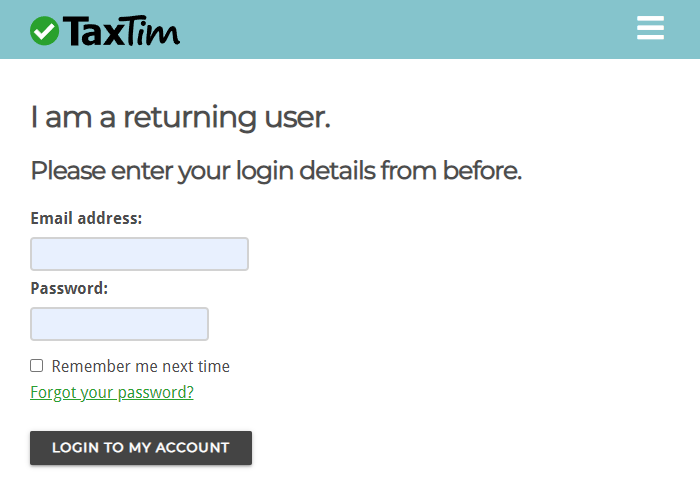

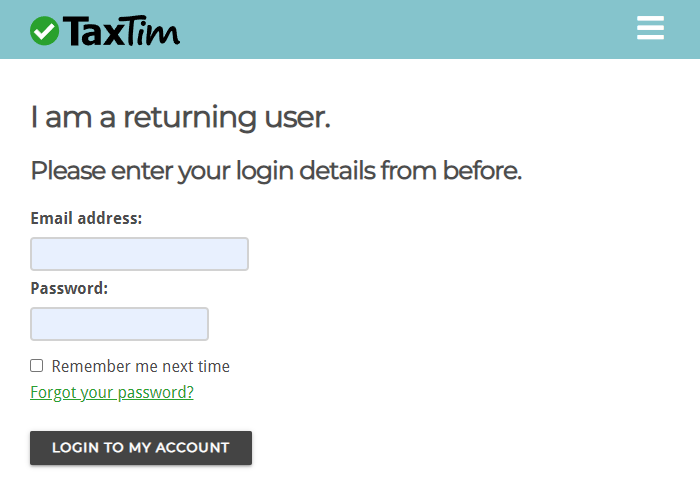

1. Login to your TaxTim profile.

2. Click the My Returns button in the top header menu.

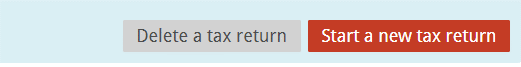

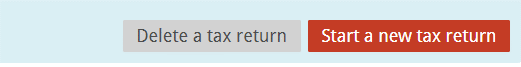

3. Click on Delete a tax return.

4. Then click on the tax return you wish to delete.

Read more →

I need to pay SARS

Written by Alicia

Posted 8 December 2022

When should I pay SARS

You’ve received your assessment, sent SARS your supporting documents but owe SARS on the initial assessment, what should you do?

As soon as you receive your assessment and it confirms that you need to pay SARS an amount, you can make the payment to SARS. You can do this even if there’s a first and second due date on your assessment to make the payment, if you are able to make the payment before the second due date, we suggest you pay SARS to ...

Read more →

Why can't I see my return on eFiling after TaxTim submitted it for me?

Written by Marc

Updated 29 October 2022

Why can’t I see my return on eFiling after TaxTim submitted it for me?

If you don’t see your tax return immediately on eFiling after we’ve confirmed that it’s been sent to SARS, you needn’t panic. SARS usually processes it around 6pm on the day we submit and then it should appear in eFiling shortly thereafter.

We will then send you the assessment as soon as we receive it from SARS.

How do I review my tax return before submitting?

Written by Evan

Updated 26 September 2022

1. Finish answering all of Tim's questions in the animated chat.

2. Click Continue.

3. Continue through the return checking system and/or payment steps.

4. When you are asked how you wish to file your tax return, click on the manual filing option.

5. You will see instructions for filing on eFiling with your fully completed tax return underneath.

6. Click the Back button to choose how to file again.

How do I go back to a section on my chat with Tim?

Written by Evan

Updated 1 September 2022

Step 1: Log in to your TaxTim account.

Step 2: Click on My Returns in the top menu bar and select the applicable tax return you want to update.

Read more →

Why must I update my tax return with TaxTim?

Written by Marc

Updated 24 June 2022

Question:

I have completed my return on TaxTim already and now he is asking me to update some information before he can file? Why is that? Will I lose my information? Do I have to pay anymore money?

Answer: For each tax season, SARS makes some changes to the tax return on eFiling. It looks slightly different to what it looked like in the past and there is a bit more information needed than in previous years.

In order for TaxTim to continue providing the quick and easy service we needed to update our return and questions to match SARS. Don't worry though, there is no difference in the TaxTim side and it will be like nothing has changed for you. ...

Read more →

Why do I not have a make payment button on my additional ITA34?

Written by Marc

Posted 16 March 2022

If your ITA34 does not have a Make Payment button, then this means that the particular ITA34 you are looking at has a R0 assessment. Rather log back into eFiling and select the following:

- Returns;

- Returns History;

- Select the year you wish to make payment for;

- Select the second to last ITA34, so the one before the current one you are looking at (often the original assessment); and

- There should be a Make Payment Button on there for you to m...

Read more →

How do I upgrade my package with TaxTim?

Written by Marc

Posted 16 March 2022

In order to upgrade between the LITE, SMART and ULTRA packages please follow these simple steps:

- Click MY RETURNS at the top of your screen when logged into your TaxTim Profile;

- Select the return you wish to upgrade your package for;

- Look on the left hand side of your screen; above Tim’s head you will see the word Sections;

- Click Sections and a drop down will appear; this will allow you to click Add Section;

- Select the sections you ...

Read more →

How do I add a section with TaxTim?

Written by Marc

Posted 16 March 2022

In order to add a section when completing your chat with Tim please follow these simple steps:

- Click the Sections Tab on the left side of your screen, just above Tim’s face;

- Click Add Section; and

- Select the Section you wish to add from the list of suggested tax return sections

You will now be able to go back to your chat with Tim and complete your return for TaxTim to submit to SARS.

How do I make changes to my return?

Written by Marc

Posted 15 March 2022

If you wish to make changes to the information on your TaxTim return then simply follow these easy steps:

- Click MY RETURNS on the top of your TaxTim login page;

- Click the return you wish to make changes to;

- Navigate to the Sections button which is located above Tim’s head in the chat you are having;

- Click Sections and the different parts of the tax return will appear;

- Click the section you wish to make a change to and then you will ...

Read more →

What do I do if a question doesn't apply to me?

Written by Marc

Posted 15 March 2022

Question: What do I click if a TaxTim question isn't relevent or does not apply to me?

Answer: There should be an option to click "doesn't apply", by clicking this it will automatically mark the question as R0 and show SARS that this isn't relevent to you.

I have a new email address, how do I transfer my profile?

Written by Evan

Posted 15 March 2022

1. Login to your TaxTim profile.

2. Click on My Profile in the top menu bar.

3. Update your old email address to the new one you wish for us to contact you on.

4. Click the Update button.

All correspondence from TaxTim will now be sent to this new email address.

Your details at SARS will NOT be updated by this action.

Should you wish to do this too, you can call the SARS call centre at 0800 007 277 or you can log in...

Read more →

Can I add two tax numbers to my TaxTim profile?

Written by Alicia

Posted 4 February 2022

Some users have asked for a way to register more than one tax number / SARS tax profile using the same email address. Our website does not allow for multiple tax profiles to be stored under one email login currently, but we can suggest two potential workarounds:

1) Register on the TaxTim website again, but use a different email address that you have access to, perhaps a work email address or your spouse's email address. You will then...

Read more →

I have more than one employer / multiple IRP5s

Written by Evan

Posted 12 October 2018

If you worked for multiple employers and/or have several IRP5/IT3a documents, please take note of below.

Make sure that all of your documents relate to the tax year you are busy with. Any IRP5s from previous (or future) years do not get entered in the same tax return. The document will usually state the tax year clearly, and the employment dates will fit within the tax year opening and closing dates.

You can not add multiple IRP5 documents together. They need to be entered one by one, one after the other. The sequence is not important....

Read more →

I started a tax return for the wrong year

Written by Evan

Posted 27 September 2018

If you started a tax return for the wrong year, please follow the steps below:

1. Login to your TaxTim profile.

2. Click on My Returns in the top menu bar.

3. Click the x button next to the tax return that you do not need any more.

4. Click Start new return to start a new tax return that relates to the year you need.

Please send a message to ou...

Read more →

Written by Nicci

Written by Nicci

Written by Alicia

Written by Alicia

Written by Evan

Written by Evan

Written by Marc

Written by Marc